India’s Private Equity Space- Landscape, Outlook, and Opportunities

Date & Time:06th January 2022, 04:00 PM – 05:00 PM IST

Speaker: Ashish Agarwal, Managing Partner and Head – Private Equity, Edelweiss AMC

Moderator:Kamal Manocha, Founder & CEO, PMS AIF WORLD

The visible stupendous over-subscriptions of the IPOs in the recent past shows the investor’s attraction to the new age listed businesses. PE firms that deploy correct tools, knowledge, and the resources to invest in the late stage of the business in form of Pre-IPO investment thus have made good returns. However, investing in the mid-stage can also be fruitful. And, to understand, this space, PMS AIF World conducted a webinar with Mr. Ashish Agarwal, Managing Partner and Head– Private Equity, Edelweiss AMC. Mr. Ashish Agarwal has over 20 years of experience in the markets with over 5 years of experience in the Silicon Valley.

Through this article, we at PMS AIF World, strive to highlight the opportunities and the landscape that current private equity space in India offers.

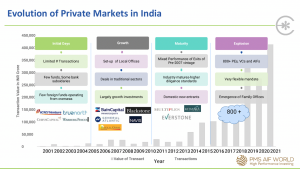

The PE’s and VC’s have done a business of ₹100k cr to ₹ 400k cr in the last five years. The average deal size currently stands at 300 cr for private equity firms.

The last 5 years have been very successful for the PE/VC industry as it has offered increased liquidity along with the accelerated growth of the digital economy. Investors have shown faith in the private market by reinvesting the proceeds from the same. It has attracted more competitors and investors in the private equity space. It was only in 2018 that we were able to see massive changes in the investment styles.

Prior to 2018, deal sizes were smaller, and a conservative approach was more evident. It had a timeline of 4-6 months and focus was primarily on transactions ranging from $20m-$50m. On the other hand, post 2018 has seen an aggressive style of investing. Deal sizes are even larger than before as focus has shifted to $50m+ transactions in the market. It has a shorter timeline of 3-4 months and continues to have a prominence in the market.

The growth seen in private equity space is structural rather cyclical, albeit with some volatility

The growth of an attractive set of companies in India’s digital economy and as iterated previously, the increased liquidity in the private equity sector are the two reasons for the sustenance of the structural growth. A survey of the top 80 institutional investors revealed private equity is still a small % of the global investments. However, allocation towards private equity has uni-directionally increased over the last 10-12 years.

Private equity’s buoyancy into mainstream investing is quite commendable as it still has a smaller share of the pie as far as investments in Asia are considered. India has shown the fastest growth rate for allocation towards PE’s.

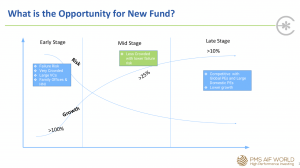

The growth curve and the risk curve are significant in the early stages of the company which soon leads to the growth curve dominating in the later stages of business. Moreover, the company’s failure risk diminishes, which results in a higher confidence in the product and a sound investment avenue for many.

FY17-19 witnessed 25% revenue growth after an entry of a PE in the mid-stage of a business cycle. The investments range from $10-$15m while the Average Revenue Rate increased 4x for the same amount. Nykaa is a classic example wherein the value increased 4x from a company in the mid-stage to being listed on the bourses. Its valuation increased 22x when compared to the Series E and the IPO that followed. Hence, mid-stage investing in the private equity space in India is quite compelling given the fabulous trend record over the last year or so.

Time horizon plays a crucial role while calculating returns for public equity or for private equity. Mr. Kamal Manocha, Founder & CEO, PMS AIF World, remarked that a poll suggested that targeted returns for the PE space stand at 30% while the listed space should provide a return of 20%. The returns described for the PE’s in the webinar were 10-year close ended products and hence spoke volumes. A larger time horizon brings enough clarity and a reasonable rate of return as well.

A report shows that global PE market has had a trend of a higher return in the top decile than global listed markets. The recent run of IPO’s in the Indian market has shown that a large portion of gains for the PE’s has come from the listing gains. A set of PE firms target businesses that have high potential on being listed and on the other hand, a few PE firms target quality businesses irrespective of their stage in the business cycle. A trade sale or a buyout could give sufficient gains to the latter PE firms.

The biggest learning in the PE space is to make the correct investment decision after thoroughly going though numerous company documents

The absence of a regulatory framework around due diligence of PE firms has left quite a few investors worried. The company’s accounting, legal and commercial position will have to be thoroughly studied by private investors. Robust disclosures required by SEBI in the red-herring prospectus have helped quite a few IPOs that listed recently in the market with negative earnings. The book building method ascertains the listing price wherein the financial institutions have shown the appetite to pick up such IPO stocks.

The returns in the equity market are easily measured using the CAGR, however, measurement of returns in the unlisted space has raised a question from the audience as to the correct metric to measure the same. It was articulately put by Mr. Ashish Agarwal, that CAGR measures the company’s performance over a period of time. The IRR is a metric that measures the return on any particular investment.

Even after having several hurdles in the path of investment, PE space offers a unique investing medium for all its investors. Firstly, the sustenance of the high valuations has been questioned and it’s time to see the correct picture. Secondly, a high-quality business (both, in terms of product and management) will deliver superior returns over a long period of time. Lastly, investors have misunderstood those businesses with cap tables involving big institutional investors are bound to perform well. But sadly, that is not always true.

Investing in the mid-stage of a business cycle, where the ARR ranges from 100cr – 300cr, turns out to be profitable. The essential premise is that good quality companies seldom face difficulty at the hands of investors that look for an exit.

Mr. Kamal Manocha, Founder & CEO, PMS AIF World, asked a pertinent question about the diversification metrics that will be followed by Edelweiss AMC’s new fund. Risk is mitigated to quite an extent through diversification. Investing in PE space is not extremely risky but the linkage between the performance of the listed equities and the exit route of a private business plays a massive role. Investing in the mid-stage private equity space can be diversified by selecting 10-12 quality businesses.

The current health scenario has led investors to ask another pertinent question as to the viability of making an exit during difficult times and also having an investment that matures simultaneously. Investors need to be patient with the amount they have foregone as it will reap benefits only over a long period of time. Moreover, the set of tools and knowledge present with a fund house are unique and large as compared to individual investors. Hence, the fund house is able to make an easy and quick decision.

Secondary sale transactions accounted for $13bn in India last year. It shows that a secondary route is equally powerful when compared with an IPO in the later stage of the business cycle. No doubt, the current scenario and the recent past has shown that VC firms with suitable IPO plans have put up a stupendous performance. However, a longer period of tenure has a massive impact on the multiples of the business.

Mr. Ashish Agarwal of Edelweiss AMC claims that quality trumps momentum over a period of time, hence, it is crucial to have a conducive investment environment.

The journey of an unlisted growth-oriented company to a listed one has offered investors stupendous returns irrespective of the economic cycle and the market environment during an exit

It is important to have more time in the market rather than timing the market as put forth by Mr. Kamal Manocha. The combination of time in the market and timing the market is bound to deliver returns but the latter is quite difficult to carry out. There are several good opportunities to invest given the current scenario with a 7-year time horizon. Concluding the webinar, the presentation of returns was touched upon as it remains opaque for many investors. The resource intensive approach is one of the reasons for higher management fees as compared to funds that dive into listed equities.

Quality investments do deliver over a long period of time and India’s private equity space has a lot of opportunity for investors to make superior returns. The landscape and the outlook is quite positive as of now and with the ground all set, investors should make an informed decision and have faith on the skills of the fund manager while awaiting the numbers at the time of maturity.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF World do such a detailed 5 P analysis.

Client Stories

Designing better experiences is a journey.

-

What makes me recommend Hewepro CAPITAL is that now I have access to all on my financial investments across products at one glance. Sensible investments, unbiased product selection, flawless technology, customized hand-holding. All this for a fair fee that is not correlated to portfolio value is just the right kind of advisory model that I was looking for.Shantanu Kumar, Gurgaon

-

Cost Advantage

I have been investing in mutual funds through a bank, and then when I discovered the cost advantage of direct investing, I started dealing with online platforms that provide direct mutual funds. I also dealt with asset management companies directly. But, in all experiences, I saw huge gaps and/or conflicts of interest. While banks were always keen to just sell a product for a commission, online platforms were not capable to understand my risk preferences and were not actively involved to review portfolio-level performance. They were claiming artificial intelligence, but actually were lacking even in common sense! AMCs have a limitation of bias towards their own products. Hewepro CAPITAL addressed all these issue. They provided flat fee, no product bias, advise objectively basis client risk and product risk-adjusted performance. Their approach is right and is the way to go for this industry. I have recommended this to my colleagues and will happily recommend to all.Yogesh Manocha, Delhi -

Perceptive and Right

They have everything in place. Years of experience, disciplined approach to investing, Robust technology platform, Amazing reporting system. All this for a few lacs on my portfolio is what I was looking for. I recommend Hewepro CAPITAL to all investors looking for perceptive and right investment services.Lokesh Mahajan, Delhi -

Responsive, Sensible and Focused

If you want to know anything about investing, Hewepro CAPITAL is the way to go. Flat fees, responsive staff, direct investments, online tracking, one click transactions and sensible advice make this an easy decision. I can clearly see the difference between their advice and the biased advice I get from banks and other distributors. I’m very happy with their service. I can focus on my work because I know they are focused on theirs.Anubhav Rohatgi, Gurgaon -

Just the Right kind of Advisory

What makes me recommend Hewepro CAPITAL is that now I have access to all on my financial investments across products at one glance. Sensible investments, unbiased product selection, flawless technology, customized hand-holding. All this for a fair fee that is not correlated to portfolio value is just the right kind of advisory model that I was looking for.Shantanu Kumar, Gurgaon -

Rare Combination of Intent, Knowledge and Discipline

The intent of an advisor matters the most. After having dealt with banks and other distributors for years, I find Hewepro CAPITAL different and a rare combination of right intent, advisory know-how, and disciplined approach to investing. All this along with consolidation of my investments at one place and flat fee model adds immense value to my investment portfolio. I happily recommend their service.Surinder Popli, Delhi -

Discipline and Integrity

Disciplined approach with solid integrity focused on Wealth Management and responsible advisory.R K Aggarwal, Delhi -

Class Apart

We have worked with largest MNC bank, Indian private bank. Hewepro CAPITAL is class apart; truly client-focused. Team of people with amazing integrity and values. They have sound understanding of the advisory industry, products, and are going to create a special market for themselves as there is a huge need for honest, ethical and sound investment advisory.Raman John Kapur, Landour -

Refreshing departure from the stereotypical pattern

I have never had a satisfactory experience in the past with financial advisors from big institutions . Their emphasis was to off-load products attractive to their interests even though they were not conducive to the client’s portfolio. Hewepro CAPITAL provides a refreshing departure from the stereotypical pattern. They study your needs and jointly develop a portfolio to meet your long-term aspirations. The products are well researched, service is provided for the transactions to happen in the e-mode. Their website provides comprehensive information not only on the portfolio status, but of dividends, short and long-term gains, tax implications and history of transactions. This is the kind of service I have been looking for – expert advice and service available all the time without having to worry about timelines. It is nice to have one place to come to, without being intimidated by relationship managers from larger institutions. This is what financial advisors should be.Satish Bhatia, Gurgaon

Clients Served

AUM

Countries

Cities

ABOUT OUR COMPANY

Hewepro stands for Health, Wealth, and Prosperity. Thus, we offer comprehensive Investment & Capital services, with an endeavor and promise to smoothen your Wealth Creation journey. Over 5+ years, we have been managing 500+ UHNI & NRI families, across 1000 Cr+ assets. We offer responsible, long term investment service Invest with us in the best quality products and make informed investment decisions.

© 2024 Hewepro Capital. All Rights Reserved