Why Should one stay invested in equities?

Dear Equity Investor,

Creating wealth from equity investments isn’t easy. It generally takes all you’ve got, and some time even more, as every time is the time of new learning. Only those who love the journey, win, as perseverance and conviction matter, at last. This is only possible if one doesn’t get carried away by losses or fall in price after investment.

If what you own is good, it will pay-off; keep the conviction.

While your mind could be crowded with negative emotions owing to many negatives like the rise in inflation & interest rates, FII selling, ongoing war, Liquidity reducing, and so on, let us give you a breather by talking about 10 positives that are encircling the economy right now:

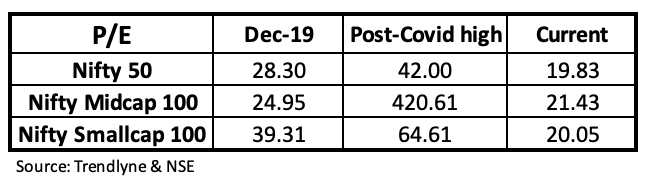

1) The P/E levels of broad market indices are currently citing reasonable valuations as they’re reasonably down from their post-Covid highs.

2) India’ GDP forecast for India stands at 7.5% for Year 2022 and 8% for Year 2023.

3)The gross GST collection in April 2022 all time high, at Rs 1,67,540 crore.

4) According to CMIE Data, the overall unemployment rate in India fell to 7.6% in March 2022, which was 8.10% in February 2022.

5) The Consumer Confidence in India continued to rise to reach 71.7 in March of 2022 from 64.4 in January. It is the highest reading in two years, amid improved sentiments on general economic situation, employment and household income.

6) The services sector in India recorded strong growth in the month of April. The seasonally adjusted S&P Global India Services PMI Business Activity Index jumped to a 5-month high of 57.9 in April, from 53.6 in March.

7) The pace of bank credit growth hit 9.6% in FY22, up from 5.6% in FY21.

8) The domestic air passenger traffic increased a sharp 83% year-on-year (y-o-y) to an estimated 10.5 million, bringing it closer to pre-Covid levels of April 2019.

9) According to the data released by the FADA, vehicle retail sales increased by 37% in April 2022, compared to the same month last year.

10) India’s merchandise exports rose by 24.22% year-on-year to USD 38.19 billion in April 2022 on the back of healthy growth in the sectors like petroleum products, electronic goods and chemicals, the government data showed.

We understand that the current corrective state of markets would be unsettling to your mind; but this to re-assure you that Equities are meant for long-term. We are in the golden phase of growth in corporate earnings, stable government, broad-based equity participation like never before and fair valuations. With your portfolio in the hands of the right portfolio managers, it’s bound to give returns over a period of time. And we are reviewing and watching this very closely and objectively.

They say all things come to an end—the good and the bad. So, this bearish phase shall pass through, as well.

And, as far as equity investing is concerned, instead of being fearful, approach should be entrepreneurial, and hence the current phase of fall in prices is more of an opportunity!

OUR INTENTION IS TO SHARE KNOWLEDGE DURING THE PHASE OF DARKNESS AS KNOWLEDGE IS A TORCH LIGHT TO PASS IT THROUGH!

Do not Simply Invest | Make Informed Decisions

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF World do such a detailed 5 P analysis.

Client Stories

Designing better experiences is a journey.

-

What makes me recommend Hewepro CAPITAL is that now I have access to all on my financial investments across products at one glance. Sensible investments, unbiased product selection, flawless technology, customized hand-holding. All this for a fair fee that is not correlated to portfolio value is just the right kind of advisory model that I was looking for.Shantanu Kumar, Gurgaon

-

Cost Advantage

I have been investing in mutual funds through a bank, and then when I discovered the cost advantage of direct investing, I started dealing with online platforms that provide direct mutual funds. I also dealt with asset management companies directly. But, in all experiences, I saw huge gaps and/or conflicts of interest. While banks were always keen to just sell a product for a commission, online platforms were not capable to understand my risk preferences and were not actively involved to review portfolio-level performance. They were claiming artificial intelligence, but actually were lacking even in common sense! AMCs have a limitation of bias towards their own products. Hewepro CAPITAL addressed all these issue. They provided flat fee, no product bias, advise objectively basis client risk and product risk-adjusted performance. Their approach is right and is the way to go for this industry. I have recommended this to my colleagues and will happily recommend to all.Yogesh Manocha, Delhi -

Perceptive and Right

They have everything in place. Years of experience, disciplined approach to investing, Robust technology platform, Amazing reporting system. All this for a few lacs on my portfolio is what I was looking for. I recommend Hewepro CAPITAL to all investors looking for perceptive and right investment services.Lokesh Mahajan, Delhi -

Responsive, Sensible and Focused

If you want to know anything about investing, Hewepro CAPITAL is the way to go. Flat fees, responsive staff, direct investments, online tracking, one click transactions and sensible advice make this an easy decision. I can clearly see the difference between their advice and the biased advice I get from banks and other distributors. I’m very happy with their service. I can focus on my work because I know they are focused on theirs.Anubhav Rohatgi, Gurgaon -

Just the Right kind of Advisory

What makes me recommend Hewepro CAPITAL is that now I have access to all on my financial investments across products at one glance. Sensible investments, unbiased product selection, flawless technology, customized hand-holding. All this for a fair fee that is not correlated to portfolio value is just the right kind of advisory model that I was looking for.Shantanu Kumar, Gurgaon -

Rare Combination of Intent, Knowledge and Discipline

The intent of an advisor matters the most. After having dealt with banks and other distributors for years, I find Hewepro CAPITAL different and a rare combination of right intent, advisory know-how, and disciplined approach to investing. All this along with consolidation of my investments at one place and flat fee model adds immense value to my investment portfolio. I happily recommend their service.Surinder Popli, Delhi -

Discipline and Integrity

Disciplined approach with solid integrity focused on Wealth Management and responsible advisory.R K Aggarwal, Delhi -

Class Apart

We have worked with largest MNC bank, Indian private bank. Hewepro CAPITAL is class apart; truly client-focused. Team of people with amazing integrity and values. They have sound understanding of the advisory industry, products, and are going to create a special market for themselves as there is a huge need for honest, ethical and sound investment advisory.Raman John Kapur, Landour -

Refreshing departure from the stereotypical pattern

I have never had a satisfactory experience in the past with financial advisors from big institutions . Their emphasis was to off-load products attractive to their interests even though they were not conducive to the client’s portfolio. Hewepro CAPITAL provides a refreshing departure from the stereotypical pattern. They study your needs and jointly develop a portfolio to meet your long-term aspirations. The products are well researched, service is provided for the transactions to happen in the e-mode. Their website provides comprehensive information not only on the portfolio status, but of dividends, short and long-term gains, tax implications and history of transactions. This is the kind of service I have been looking for – expert advice and service available all the time without having to worry about timelines. It is nice to have one place to come to, without being intimidated by relationship managers from larger institutions. This is what financial advisors should be.Satish Bhatia, Gurgaon

Clients Served

AUM

Countries

Cities

ABOUT OUR COMPANY

Hewepro stands for Health, Wealth, and Prosperity. Thus, we offer comprehensive Investment & Capital services, with an endeavor and promise to smoothen your Wealth Creation journey. Over 5+ years, we have been managing 500+ UHNI & NRI families, across 1000 Cr+ assets. We offer responsible, long term investment service Invest with us in the best quality products and make informed investment decisions.

© 2024 Hewepro Capital. All Rights Reserved